As we step into 2026, the economic landscape continues to shift, placing unprecedented pressure on both businesses and their workforce. With the cost of living still a major concern, understanding what truly drives employees has never been more critical for recruitment and retention.

At the end of 2025, we conducted our annual snap survey of 5,000 professionals. The research asked UK workers about their current and preferred salary and benefits, their organisation’s performance and priorities, how they rated their job satisfaction and career prospects, as well as the key recruitment and skills trends they’re witnessing.

These insights complement our 2026 salary guides, adding real-world perspectives to market data and helping employers and professionals understand not just what people earn - but what they value.

This article shares the top trends that the survey revealed.

1. Financial strain is widespread

The overwhelming reason for salary dissatisfaction (52% of unhappy respondents) is that pay hasn’t kept pace with the cost of living. This far outweighs other factors, such as workload or industry pay.

Declining affordability: Only a quarter of the population (25%) feels they’re earning more in terms of what they can afford compared to four years ago, before the cost-of-living crisis.

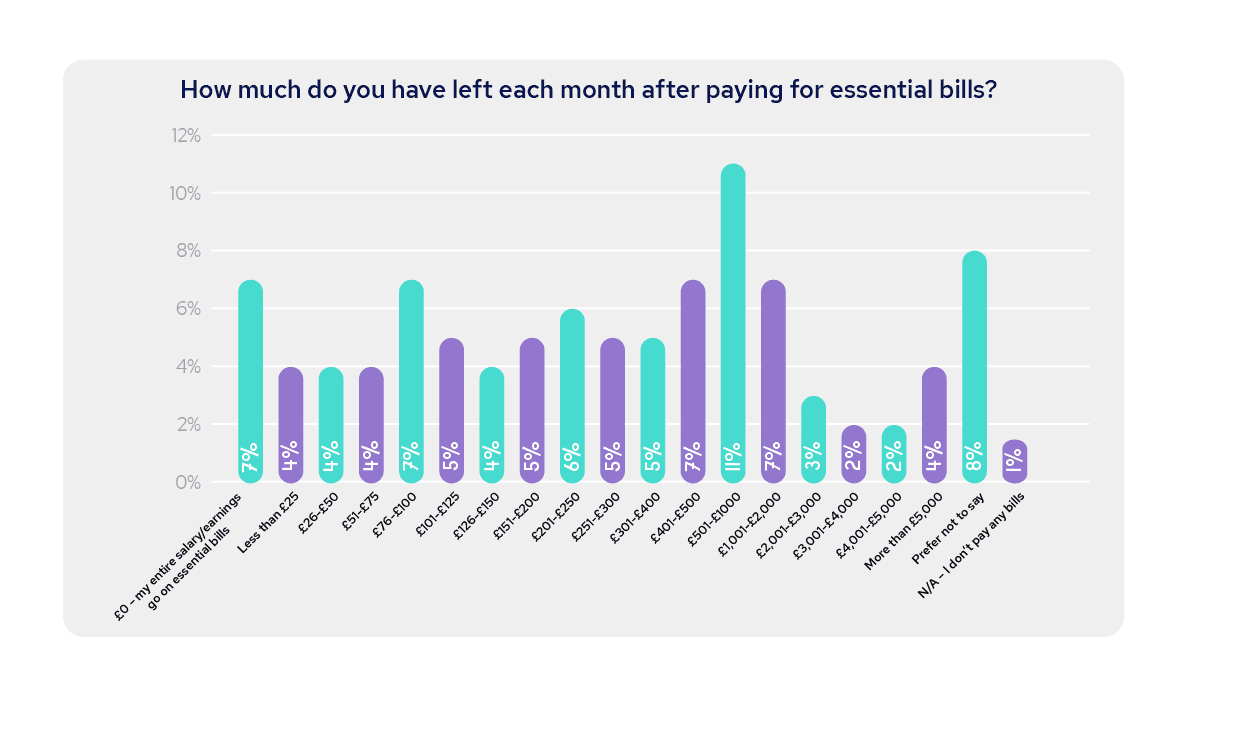

Limited disposable income: A concerning 26% of respondents have £100 or less leftover each month after essential bills, with seven per cent stating their entire salary goes to essentials. This highlights a struggle for many to save or enjoy non-essential spending.

2. The growing ‘comfort gap’

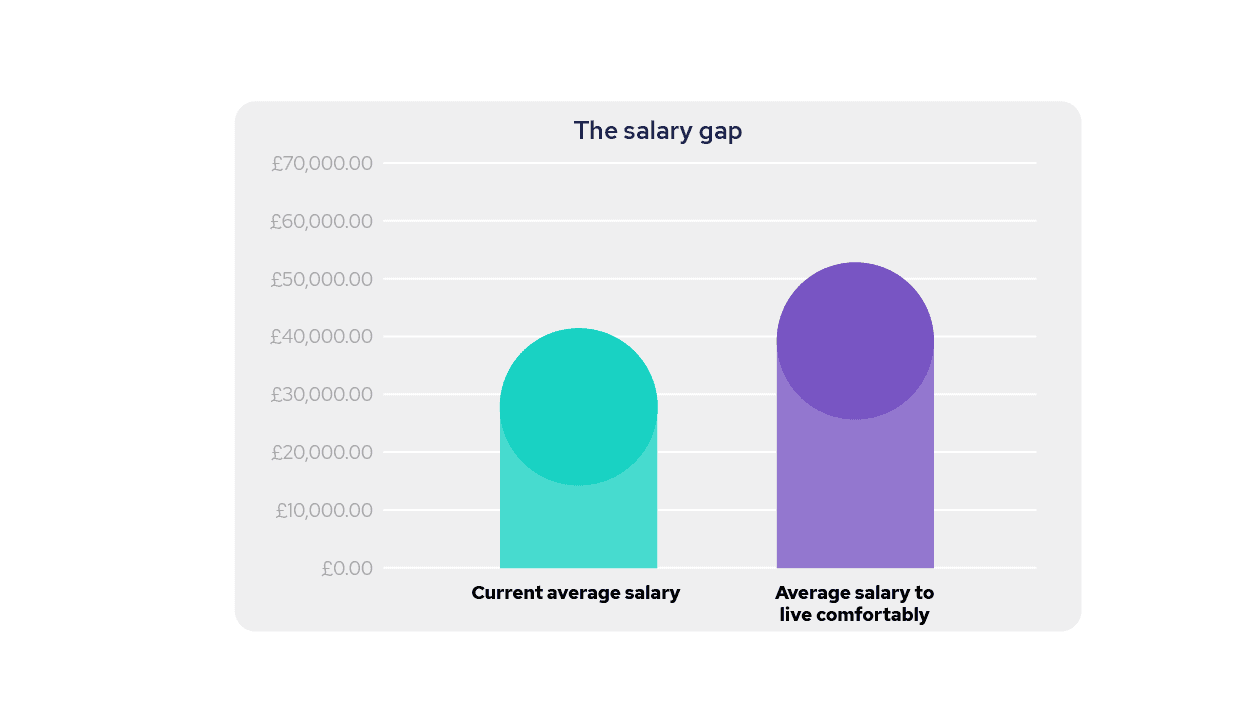

There is a stark £11,110.38 gap between what people are currently earning and what they say is their comfortable living wage.

Desired vs. current earnings: Our research found the average current annual salary is £40,638.35. However, the average income people believe they need to live comfortably is £51,748.73.

3. Salary remains the dominant job motivator

To switch jobs, individuals expect a substantial average pay increase of £12,139.55. This is significantly higher than the average £3,923.62 pay rise that would satisfy them at their current employer, indicating a clear financial incentive is needed to overcome the inertia of changing roles.

Increased importance: A vast majority (73%) report that salary is more important now when considering new job opportunities than it was before the cost-of-living crisis - 40% even say it’s “significantly more important”.

Higher progression expectations: Nearly half of the 5,000 people surveyed (44%) have increased their expectations for salary progression within their current role over the last four years.

4. Benefits are secondary to cash

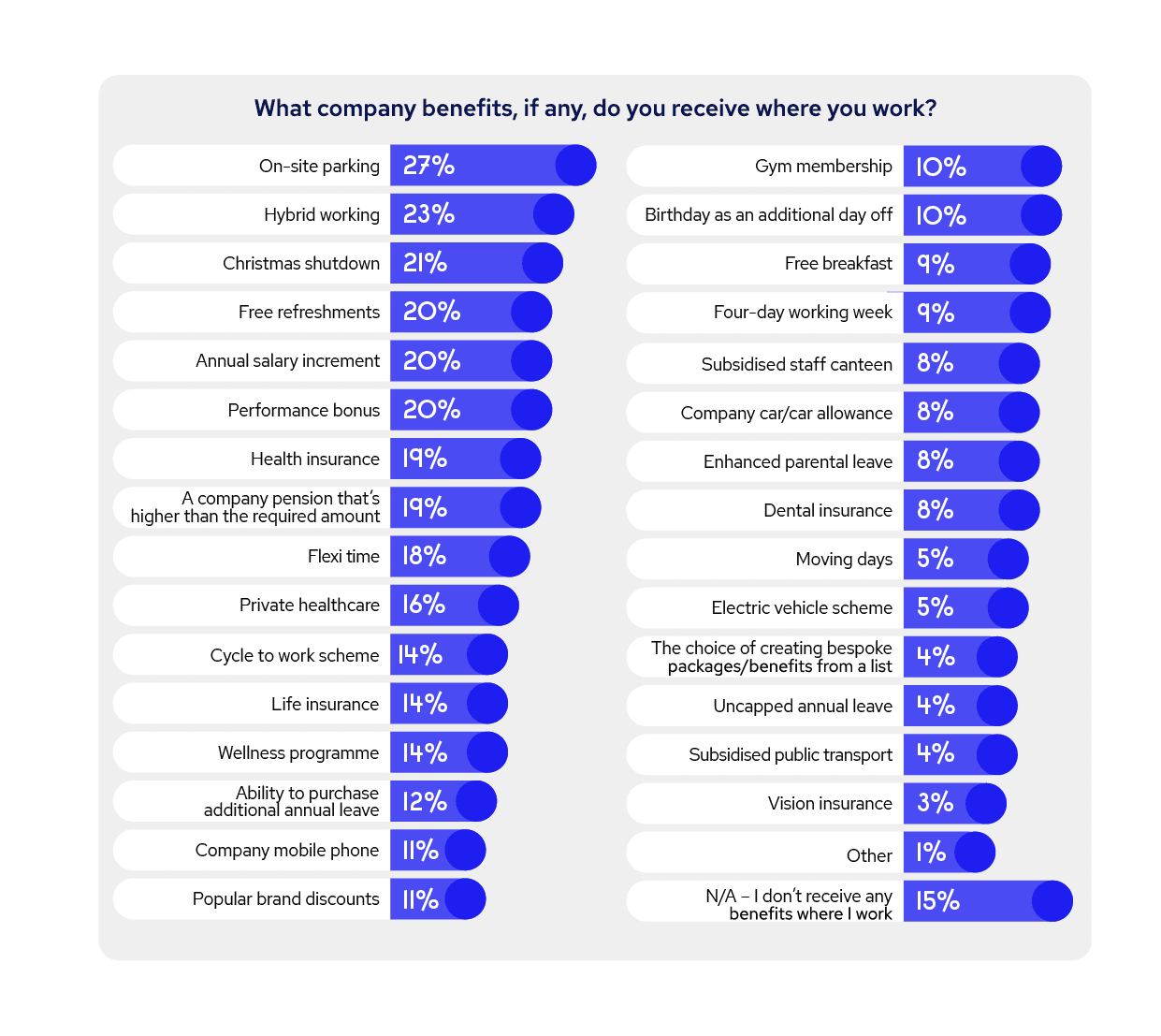

Many employees are willing to sacrifice ‘soft’ benefits like free refreshments (11%), cycle-to-work schemes (11%), onsite parking (eight per cent), and wellness programmes (seven per cent) for higher pay. Even some ‘harder’ benefits like health insurance are on the table for six per cent of those who took part.

Underutilised benefits: Some commonly offered benefits, such as cycle-to-work schemes (11% unused) and the ability to purchase additional annual leave (seven per cent unused), are not being fully utilised by employees. This suggests that while benefits are appreciated, their perceived value can be lower than direct cash compensation, especially in the current financial climate.

Prevalence of benefits: Common benefits include onsite parking (27%), hybrid working (23%), and Christmas shutdown (21%). However, 15% of respondents receive no benefits at all.

5. A highly mobile workforce

While the average tenure is 8.54 years, the high openness to new roles suggests that even long-serving employees are not immune to the pull of better compensation.

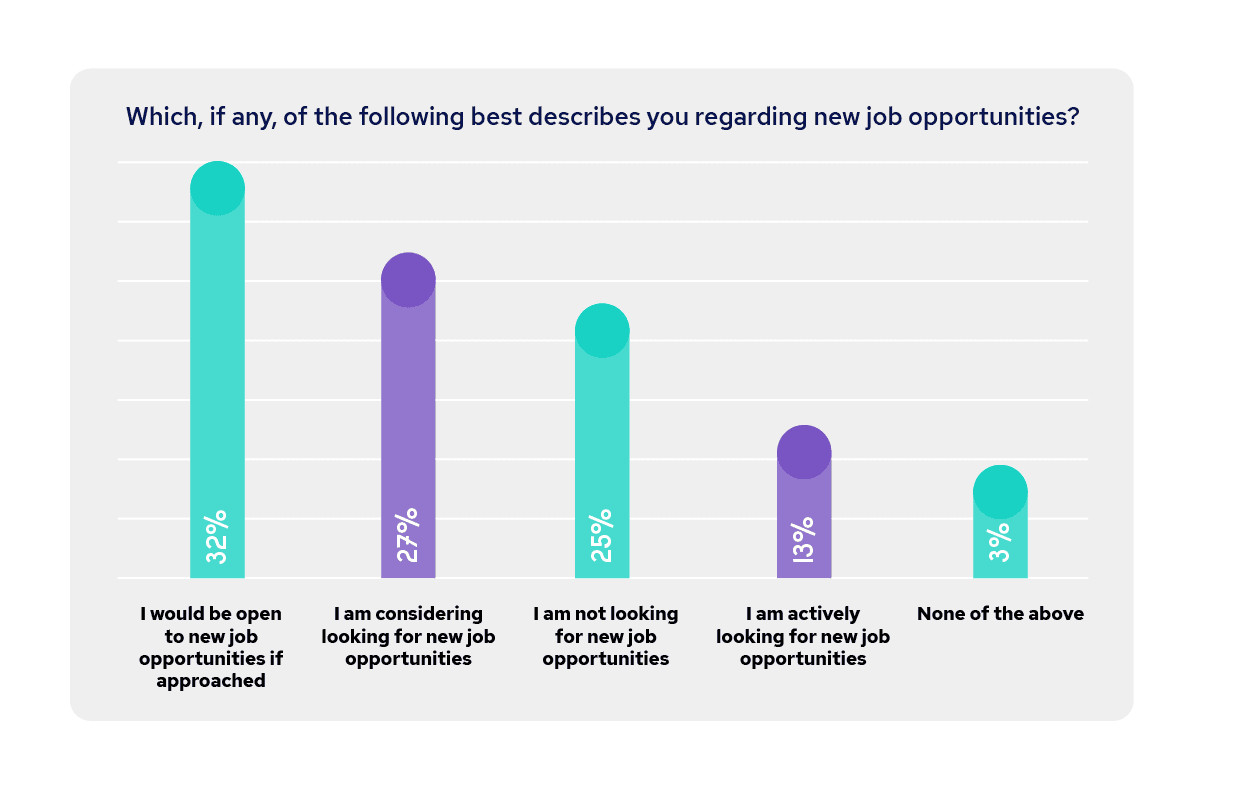

Open to new opportunities: A significant majority (72%) of the workforce is considering a new role. A third (32%) are open to new job opportunities if approached, 27% are considering looking and 13% are actively looking. Only a quarter of employees (25%) are not looking for a new job opportunity at all.

Money, money, money

With ongoing cost-of-living challenges, salaries continue to be a huge area of discussion in the employment market, for both professionals and businesses. The data reveals the UK workforce is under significant financial pressure, with a clear and growing emphasis on salary as a primary driver of job satisfaction and career decisions.

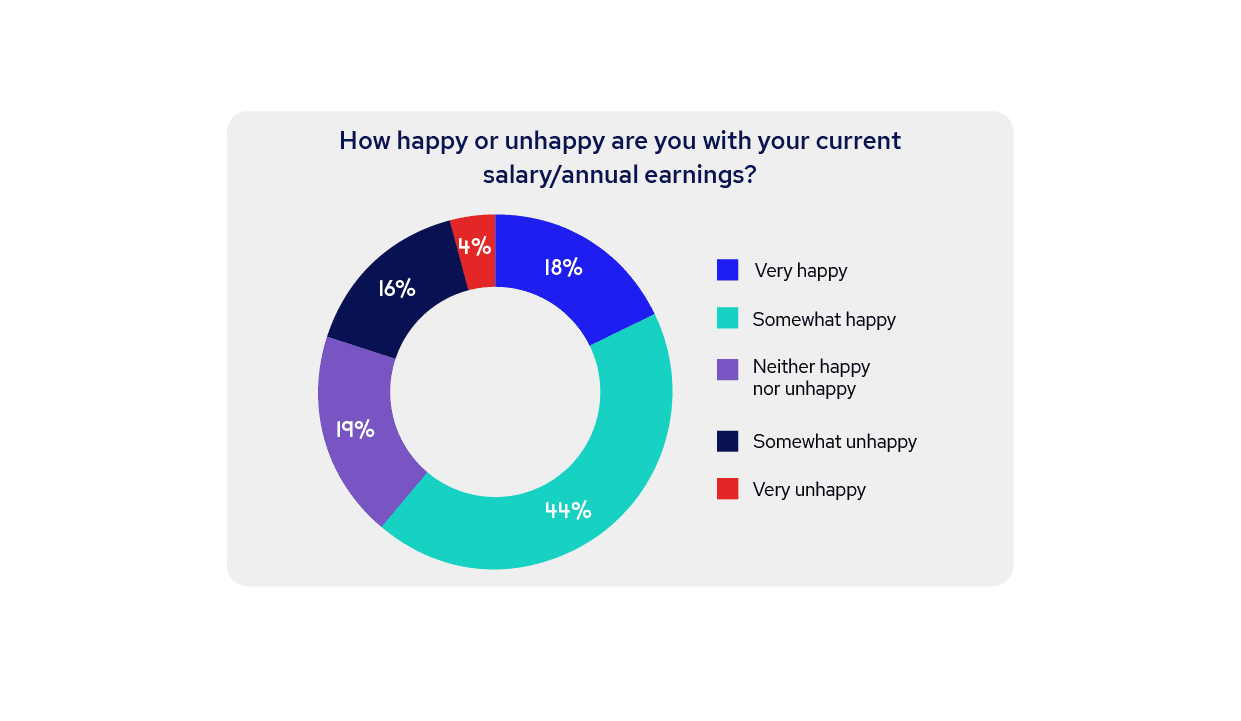

Currently, over half (61%) of workers are happy with the pay they receive. However, that leaves a significant 20% of professionals feeling unhappy with their current salary, and another 19% feeling ambivalent (“neither happy nor unhappy”).

Of those who are unhappy, the overwhelming reason, cited by over half (52%), is that their pay hasn’t risen with the cost of living. Other key reasons include feeling they “do so much more than my job role” (39%), being “unable to save enough to meet my financial goals” (37%), and their salary “not being enough to live the lifestyle I want” (35%).

The disparity between the average current wage and the salary people would be comfortable with remains substantial. This year, the average current salary for survey respondents stands at £40,638.35. However, the average income people believe they need to live comfortably is £51,748.73, representing an average £11,110.38 gap. This ‘comfort gap’ indicates a widespread desire for higher earnings.

The financial strain is evident in monthly disposable income. A concerning seven per cent of respondents have £0 leftover each month after essential bills, with their entire salary going towards necessities. Overall, 26% have £100 or less remaining for non-essential spending, savings, or leisure.

As a direct consequence of the financial climate as we enter 2026, 73% of professionals state that salary is more important now than it was before the cost-of-living crisis began in 2021, with 40% saying it is “significantly more important.” Expectations for salary progression within the same role have also increased for 44% of workers. To switch jobs, individuals expect a substantial average pay increase of £12,139.55.

A deeper dive…

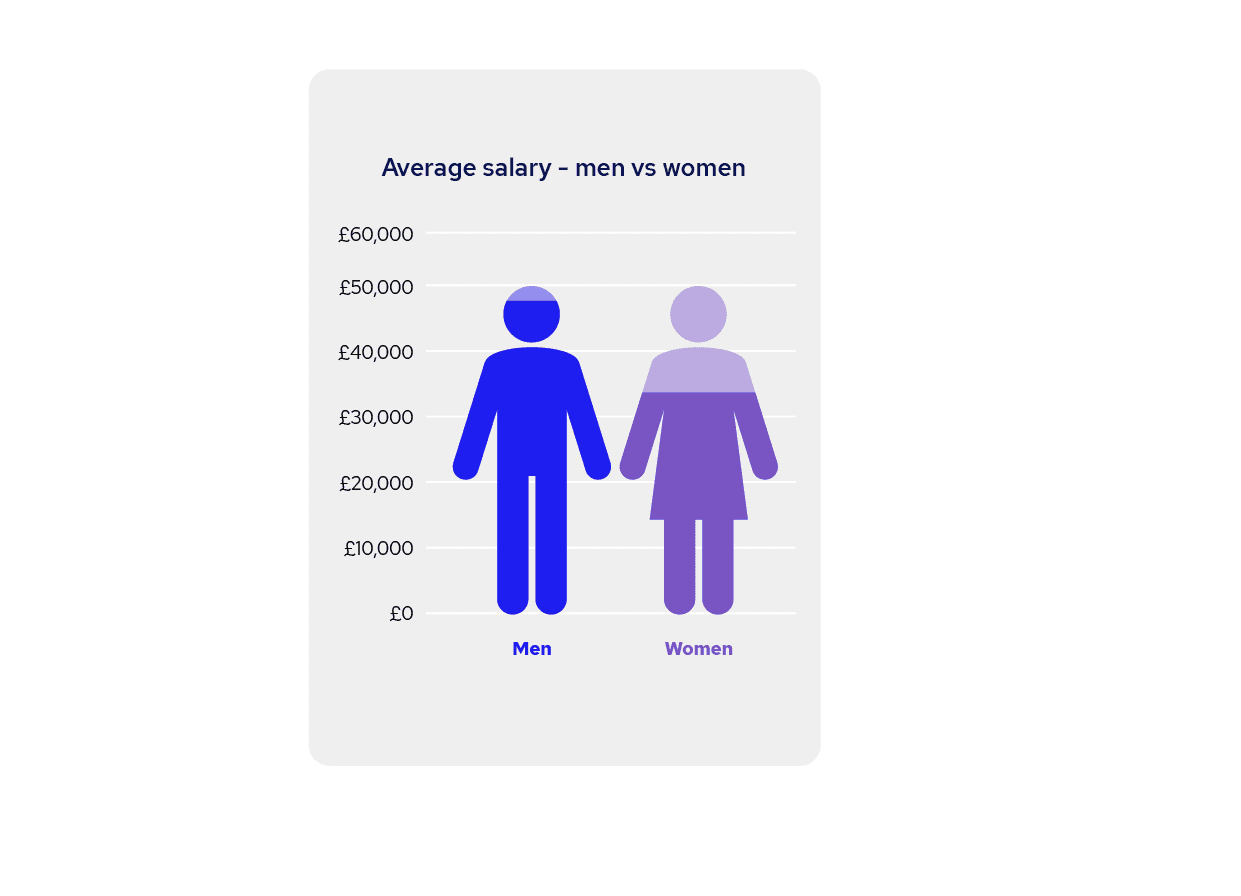

Gender pay gap: There remains a significant gender pay gap. The survey found that on average, men earn £48,367.15, while women earn £33,852.12, a difference of over £14,500. This disparity extends to satisfaction: 66% of men are happy with their salary compared to 57% of women, and women are more unhappy (24%) than men (16%). Men also perceive a higher comfortable salary (£59,688.07) than women (£44,707.25).

Disposable income gap: Women have significantly less disposable income, with an average of £626.61 left over monthly compared to £983.38 for men. Women are also twice as likely to have £0 leftover.

Age and earnings: Current salaries peak in the 25-34 age group (£49,853.43), while the desired comfortable income peaks in the 25-34 age group (£65,341.10). Salary satisfaction is highest for younger workers (18-34) and lowest for the 45- 54 age group, where only 51% are happy with their pay. This 45-54 age group also reports the highest percentage (nine per cent) with £0 leftover monthly.

Job mobility: Younger workers (18-34) are most willing to change jobs for salary increases, while older workers (55+) are significantly less likely to change jobs for more money, indicating that other factors become more important with age.

All about the benefits

While offering a higher salary remains the most direct way to attract and retain employees, the benefits package also plays a role, especially for businesses unable to match top-tier salaries. However, 15% of respondents currently say they receive no workplace benefits at all.

Commonly offered benefits include onsite parking (27%), hybrid working (23%), and Christmas shutdown (21%). However, there’s a noticeable disconnect between offered and desired benefits, and also a willingness to sacrifice many perks for higher pay.

A deeper dive…

Sacrificing perks for pay: Many employees are willing to sacrifice ‘soft’ benefits for higher pay. Free refreshments (11%) and cycle to work schemes (11%) are the benefits most employees would be willing to give up.

Age and benefits: Younger workers (25-34) are most willing to sacrifice benefits for higher pay, while older workers (55+) are significantly less willing to do so, suggesting they value their existing benefits more.

Gender benefit gap: Women are more likely to receive no benefits (17% vs. 12% for men) and, on average, men report receiving more benefits overall.

Key takeaways for businesses

Over two-thirds of professionals (72%) are currently looking or open to looking for a new job – highlighting a critical need for businesses to audit what they are offering their current and future talent. The primary drivers for this job market engagement are financial, with the cost-of-living crisis acting as a significant catalyst.

Address the ‘comfort gap’: The £11,110.38 gap between current and desired comfortable income is a major source of dissatisfaction and a driver of job mobility. Competitive salaries are no longer just about attracting talent but retaining it.

Targeted retention: Mid-career professionals (25-44) are a high-risk group, demanding the largest pay increases to switch jobs and showing the highest increase in salary progression expectations. Retention strategies must be robust for this segment.

Acknowledge gender disparities: The significant gender pay gap, lower salary satisfaction, and reduced financial flexibility for women are critical issues. Businesses must address these disparities to foster equity and retain female talent.

Strategic benefits offerings: While salary is king, benefits can still make a difference. However, businesses should evaluate the relevance and perceived value of their benefits packages. Many employees are willing to sacrifice less-valued benefits for higher pay, suggesting that resources might be better allocated to more impactful perks or direct compensation.

Prioritise financial wellbeing: The struggle to meet financial obligations and save for goals is widespread. Benefits that directly support financial wellbeing (e.g., better pensions, performance bonuses) are likely to be highly valued, especially when employees are willing to trade other perks for them.

The current economic climate has made salary a paramount concern for the majority of the UK workforce. Businesses that fail to recognise and adapt to these heightened financial expectations and disparities risk losing valuable talent in a highly mobile job market.