Looking for the most up-to-date insights on UK salary and benefits? Our 2025 guides are now available to download for free below:

The end of 2023 saw slowing inflation, a positive sign for the year ahead. But no matter what happens with the inflation rate, people will still be feeling the pinch of the cost-of-living crisis. Many will be looking for jobs that can offer the salary and benefits they need to stay afloat.

Commissioned with OnePoll, we surveyed 5,000 workers in the UK across a range of sectors to gain a better understanding of the wants and needs of the UK workforce. Using these findings, employers can tailor their salary and reward offerings to help them attract and retain professionals to grow their business.

Salaries

With ongoing cost-of-living challenges, salaries will continue to be a huge area of discussion in the employment market, for both professionals and businesses.

As many are feeling the pinch, we’ve seen more talent move around to secure higher paid roles, with businesses analysing how much they can stretch to get the people they need.

Currently, over half (56%) of workers are happy with the pay they receive, a slight incline from the previous year (53%). Although, around one-in-four (24%) professionals feel unhappy with their current salary.

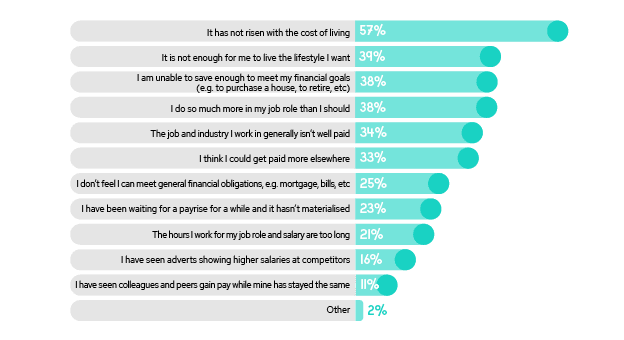

Of those who were unhappy, we asked the reasons why. They said:

As expected, continued increases in inflation and bills have put many under greater financial pressure. Over half (57%) of those who aren’t satisfied with their salary shared that this is because it hasn’t risen with the cost of living, over a third (39%) say it’s not enough for them to live the lifestyle they want, and 38% feel they are unable to save enough money to meet their financial goals.

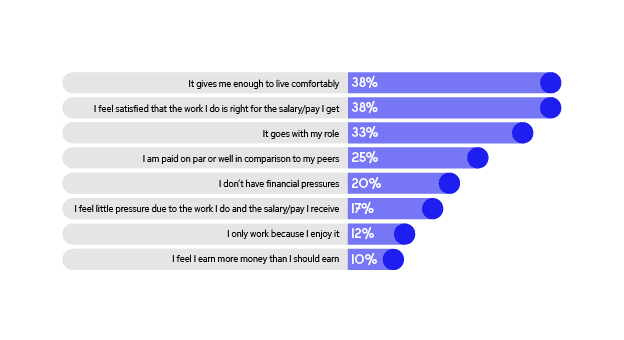

Those who were happy with their current salary were also asked why, and respondents said:

38% of those who are happy with their pay say it’s because it’s enough for them to live comfortably on, 38% feel satisfied that the work they do is right for the salary they receive, and 33% believe it goes well with their role.

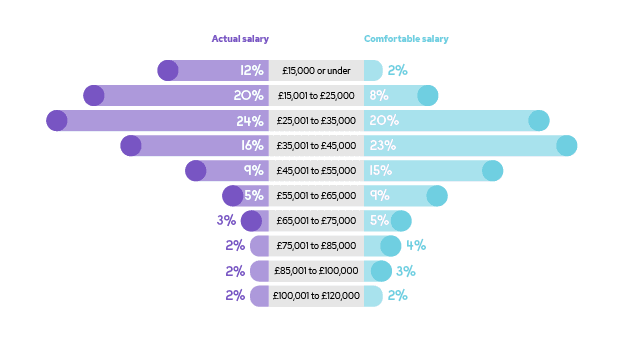

It’s essential that companies are offering employees a salary that is sufficient for them to live comfortably on, and this is something that needs to be addressed regularly to ensure it is in line with the cost of living. We asked respondents what their current salary is and what they would deem as a comfortable, ideal salary for them. We once again found a large £13,200 disparity between the two figures. Last year, this gap was £13,800 – showing a small shift in expectations.

On average, respondents are earning £35,200 per year, but state that a comfortable salary would be £48,500.

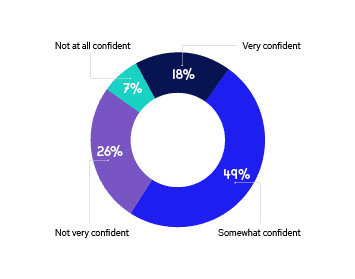

Half (50%) feel confident that they will achieve their comfortable salary at some point. Depending on whether you take a glass half empty, or half full approach, this may be an indication that those who wish to earn more may consider moving companies to secure a higher wage.

It’s worth noting that there’s a difference between men and women. Men have a higher comfortable salary of £52,000 compared to women (£45,000). And more men (57%) feel confident they will hit that salary, compared to less than half of women (44%).

Financial goals

As the economy has continued to take its toll on professionals over the past two years, we also asked people how they have been managing their wages, and whether the current financial climate has impacted their financial goals and savings.

On average, people are spending 60% of their monthly wage on essential purchases - including bills, mortgages, food, etc – with the remainder being split evenly between luxury spending and savings. In comparison to 2021, that’s an increase of six per cent going to essential purchases and a four per cent drop in luxury items.

Additionally, over one-in-five (22%) aren’t saving any of their salary because they can’t afford to do so, with a third (33%) not feeling confident they will meet their financial saving goals on time.

The cost-of-living crisis seems to be taking a heavier toll on women – they are more likely to say they can’t afford to save money – 24% compared with 19% for men. They are also less confident in achieving their financial goals: 61% of women feel confident, compared with 75% of men.

Benefits

It seems that offering a higher salary remains the most ideal way to attract and retain employees – but this isn’t viable for every business, as they are also battling rising bills and tighter overheads. Where raising salaries isn’t an option, the benefits businesses offer can potentially tip the balance when people are considering changing jobs.

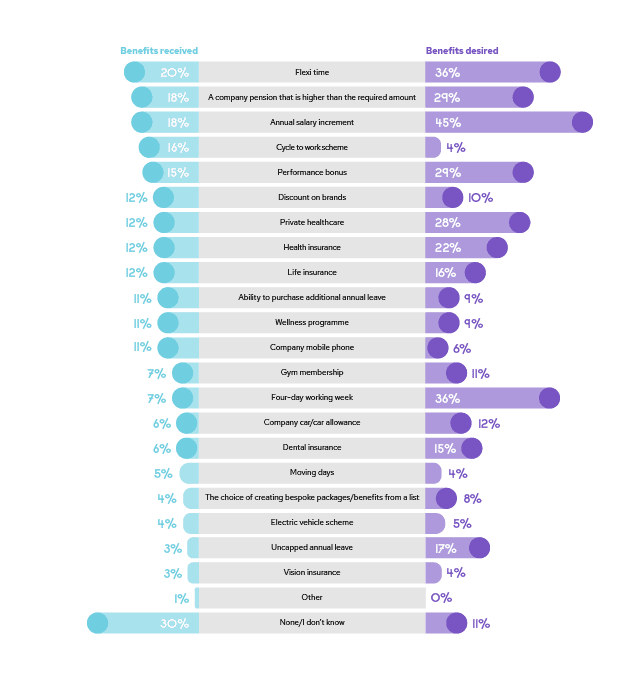

We asked respondents what benefits they currently receive from their employers and also what benefits they would find most desirable if they were looking for a new job.

Comparing these two graphs is a great way for employers to see where changes could be made to their own benefits packages and align them to the wishes of employees. Cost savings can be made by removing undesirable benefits, and replacing them with ones that will drive jobseekers to your roles and help you retain existing staff.

These are the most commonly received benefits and how desirable they are:

There seems to be a more even playing field when it comes to the benefits in demand this year versus the last few years.

In 2021, we saw higher demand for health-related benefits, which reflected the stress the pandemic had on workers. Last year, workers were feeling the initial impact of rising energy bills and inflation, which was reflected in their desire for more financial-led benefits, such as salary increments and pensions.

This year, however, there’s a greater balance between money and flexibility. There also seems to be some disconnect when it comes to offering workplace benefits. For those that do get workplace benefits, the three most common are:

flexi time (20%)

a company pension higher than the required amount (18%)

an annual salary increment (18%).

In comparison, the top-three desired benefits are: an annual salary increment (45%), a four-day working week (36%), and flexi time (36%). There’s a disparity between what is being offered and what is desired, especially as only seven per cent of workers currently receive the second most demanded benefit – a four-day working week.

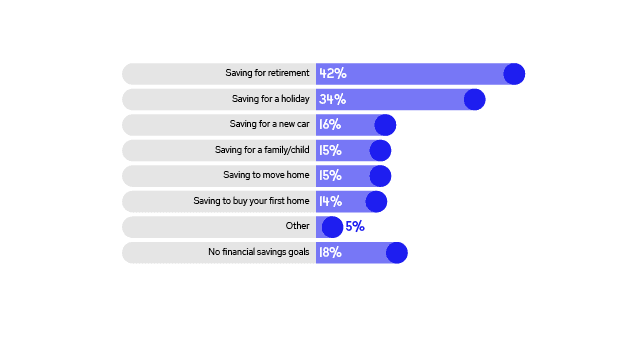

Looking into people’s savings priorities, we can also pinpoint where businesses may be able to help:

The top thing people are saving for is retirement (42%), meaning businesses that offer better pension support can be more attractive – a benefit that only 18% of workers are currently receiving but 29% would prefer.

Another top item people are saving for is a holiday (34%). In such cases, offering a performance bonus may help; a benefit that only 15% receive but, again, 29% would like.

If you are looking to benchmark your salaries against competitors in your region and industry, and gain insight into the market trends this year, our free 2025 salary guides cover 10 industries and give you all the tools you need.